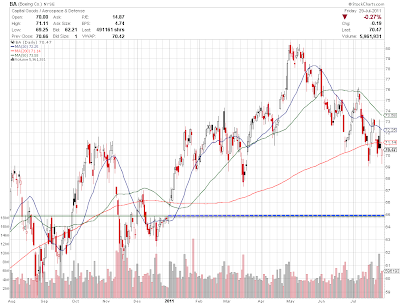

If BA slides into next week, it will hit an important support level at 64.88.

This level corresponds to a gap fill and is where the stock closed just before a sharp rally that has lasted into 2011. Market permitting, a hit of this level should lead to a significant bounce.

I will look to enter BA long on a hit or break of 64.88 and will stop out on a confirmed daily close just below. Traders willing to take on greater risk can put their stop below the nearby pivot low at 62.46.

Sunday, July 31, 2011

Trade idea: BA long

Saturday, July 30, 2011

Trade Idea: AEP long

If AEP trades down next week it will have strong support at 36.47, just below the current price.

This level has three factors to support a bounce: a previous pivot high, a gap fill and a 61.8% fibonacci retracement.

I will look to enter this trade long on a hit or break of 36.50, with a stop at a confirmed close below it. If by chance this level breaks, there will be strong secondary support at the 200 moving average.

This level has three factors to support a bounce: a previous pivot high, a gap fill and a 61.8% fibonacci retracement.

I will look to enter this trade long on a hit or break of 36.50, with a stop at a confirmed close below it. If by chance this level breaks, there will be strong secondary support at the 200 moving average.

Trade Idea: AA long levels

If Alcoa Inc. (AA) continues down next week, it will find support at two important levels. Both of these levels combine multiple support factors and so have a high probability of bouncing.

The first level is at 14.18 which corresponds with a previous pivot high and a 50% fibonacci retracement. The second level is at 13.16--the confluence of a 61.8% fibonacci retracement and the nearby gap fill at 13.10.

I will look to enter AA long on a break of 14.18 with a stop at a confirmed daily close just below it. If this level breaks, I will enter long again at 13.10.

As with any trade, remember to take partial profits early and use a break-even stop thereafter.

The first level is at 14.18 which corresponds with a previous pivot high and a 50% fibonacci retracement. The second level is at 13.16--the confluence of a 61.8% fibonacci retracement and the nearby gap fill at 13.10.

I will look to enter AA long on a break of 14.18 with a stop at a confirmed daily close just below it. If this level breaks, I will enter long again at 13.10.

As with any trade, remember to take partial profits early and use a break-even stop thereafter.

Friday, July 29, 2011

Back to regularly scheduled programming (soon)

It's somewhat ironic that the so-called, and self-proclaimed, "TSXpert"spends most of the time analyzing every micro-move of the S&P 500, America's bellwether stock index, instead of the more local Toronto Stock Exchange. Readers to this blog, or followers of mine on Twitter, may wonder if I look at the TSX at all. Such confusion is understandable.

Part of being a successful trader and student of the market is knowing where the action is, and right now that's the United States. The outcome of the present debt ceiling debates in that country will have a profound effect not only on US finances, but also the macro direction of Canadian stocks as well.

As these issues in the US continue to preoccupy global markets, the major Canadian indices have taken a second stage. Even the best technical analysis is unreliable in the face of inevitable whips and saws caused by events inside the US. For this reason, I've chosen to stick mainly to the S&P 500 as it's most closely linked to the important issues at hand as well as to American trader and investor sentiment--a key psychological indicator.

But what's here today is gone tomorrow and these issues will not be the focus of the market's attention for long. Once that's the case, I'll resume focusing on TSX analysis while always keeping a close eye on the US. But until then, enjoy the show and trade carefully.

Part of being a successful trader and student of the market is knowing where the action is, and right now that's the United States. The outcome of the present debt ceiling debates in that country will have a profound effect not only on US finances, but also the macro direction of Canadian stocks as well.

As these issues in the US continue to preoccupy global markets, the major Canadian indices have taken a second stage. Even the best technical analysis is unreliable in the face of inevitable whips and saws caused by events inside the US. For this reason, I've chosen to stick mainly to the S&P 500 as it's most closely linked to the important issues at hand as well as to American trader and investor sentiment--a key psychological indicator.

But what's here today is gone tomorrow and these issues will not be the focus of the market's attention for long. Once that's the case, I'll resume focusing on TSX analysis while always keeping a close eye on the US. But until then, enjoy the show and trade carefully.

Thursday, July 28, 2011

Markets pause as the US House votes on key debt resolution

Tonight's market wrap-up will be brief as there isn't much new to report. The markets gyrated up and down today before closing the session flat. This isn't unusual after a big move in either direction, but today it's mostly due to traders waiting for the US House of Representatives and Senate to vote on Speaker Boehner's plan to raise the debt ceiling.

The outlook for tomorrow is simple. If the House votes yes and the Senate votes no, I will expect a moderate decline in the markets. If both the House and Senate vote yes or no, I'll expect either a large rally or a large fall respectively.

The only way to handle situations like this is to tread lightly. I'm positioned mostly in cash with just a few long positions because I think a deal will eventually be struck. I'm also holding a small short hedge just in case we see further selling if no deal is reached tonight--or worse, if no deal is reached even by August 2nd. I will not be breaking the bank no matter what the outcome is.

Tonight I will be watching the futures closely to see how they react to the US House vote. I suspect that if it passes, the markets will take it as a sign of Speaker Boehner finally getting his party in line--even if the Democratic held Senate votes it down as promised. If not, it indicates that a consensus between the two parties by the deadline is increasingly unlikely.

Tomorrow's trading will be interesting to say the least. Stay nimble, and good luck.

The outlook for tomorrow is simple. If the House votes yes and the Senate votes no, I will expect a moderate decline in the markets. If both the House and Senate vote yes or no, I'll expect either a large rally or a large fall respectively.

The only way to handle situations like this is to tread lightly. I'm positioned mostly in cash with just a few long positions because I think a deal will eventually be struck. I'm also holding a small short hedge just in case we see further selling if no deal is reached tonight--or worse, if no deal is reached even by August 2nd. I will not be breaking the bank no matter what the outcome is.

Tonight I will be watching the futures closely to see how they react to the US House vote. I suspect that if it passes, the markets will take it as a sign of Speaker Boehner finally getting his party in line--even if the Democratic held Senate votes it down as promised. If not, it indicates that a consensus between the two parties by the deadline is increasingly unlikely.

Tomorrow's trading will be interesting to say the least. Stay nimble, and good luck.

Wednesday, July 27, 2011

Debt fears drive markets sharply lower

Today the S&P 500 gapped lower and continued to sell for the majority of the trading session. Traders and investors are clearly nervous that members of the US House and Senate will not be able to reach an agreement in the short term.

As I posted yesterday, I expected increased volatility as we near the August 2 deadline--and volatility usually means selling. However, even I was surprised by the ferociousness of today's sell-off.

Technically, the daily $SPX chart suffered a lot of damage. Both the 61.8 fib and the 50 moving average support levels were broken and prices closed near the lows of the day. However, it's difficult to put much meaning into this sell-off as it was driven purely by fear and not technical factors.

Whatever the reasons, I'll continue to use the charts as my guide. The markets are now very oversold and due for at least a short term bounce, but when that will happen is anyone's guess. My suspicion, as I've written about previously, is that once a debt agreement is made in the US the markets will rally.

Irregardless of an agreement, the SPY filled a key intraday gap today and that alone may be indicative of a bounce in the coming days. I personally took a small long position close to this level as I believe the markets are due for some short term relief. If we continue to fall tomorrow, I will re-evaluate this position based on several factors such as decline velocity and volume.

Please note that even though today's sell-off surprised me, I did not expose myself heavily to the long side--instead opting to slowly accumulate on the way down. The advantages to this approach are minimal losses and the opportunity to buy stocks at lower levels. It is especially important to remain prudent when there are so many political and economic unknowns looming in the near future.

Going forward into the last half of this week, remain cautious and do not weigh yourself too heavily on the short side. The market is incredibly fearful right now and that usually signals that a turning point is near.

For my latest thoughts throughout the day, be sure check here regularly and follow me on twitter.

As I posted yesterday, I expected increased volatility as we near the August 2 deadline--and volatility usually means selling. However, even I was surprised by the ferociousness of today's sell-off.

Technically, the daily $SPX chart suffered a lot of damage. Both the 61.8 fib and the 50 moving average support levels were broken and prices closed near the lows of the day. However, it's difficult to put much meaning into this sell-off as it was driven purely by fear and not technical factors.

|

| Fear drives the SPX daily below several key support levels |

Whatever the reasons, I'll continue to use the charts as my guide. The markets are now very oversold and due for at least a short term bounce, but when that will happen is anyone's guess. My suspicion, as I've written about previously, is that once a debt agreement is made in the US the markets will rally.

Irregardless of an agreement, the SPY filled a key intraday gap today and that alone may be indicative of a bounce in the coming days. I personally took a small long position close to this level as I believe the markets are due for some short term relief. If we continue to fall tomorrow, I will re-evaluate this position based on several factors such as decline velocity and volume.

|

| Gap filled after near continuous selling on SPY 10 min |

Please note that even though today's sell-off surprised me, I did not expose myself heavily to the long side--instead opting to slowly accumulate on the way down. The advantages to this approach are minimal losses and the opportunity to buy stocks at lower levels. It is especially important to remain prudent when there are so many political and economic unknowns looming in the near future.

Going forward into the last half of this week, remain cautious and do not weigh yourself too heavily on the short side. The market is incredibly fearful right now and that usually signals that a turning point is near.

For my latest thoughts throughout the day, be sure check here regularly and follow me on twitter.

Tuesday, July 26, 2011

Trade idea: CA long

CA Inc. (CA) could be poised for an inverse head and shoulders breakout if it can confirm above the blue neckline.

I will enter this trade on a confirmed daily close above the blue neckline. If it closes significantly above, I will look to enter on a retest of the neckline. A close back below the blue neckline will negate the trade and initiate a stop out.

Target 1: 24.38

Target 2: 25.06

|

| Potential inverse head and shoulder on CA daily |

I will enter this trade on a confirmed daily close above the blue neckline. If it closes significantly above, I will look to enter on a retest of the neckline. A close back below the blue neckline will negate the trade and initiate a stop out.

Target 1: 24.38

Target 2: 25.06

Markets grind sideways towards the US debt ceiling deadline

Today's trading on the S&P 500 followed the same pattern we've seen over the last several trading days. The index opened flat at 1337.39 and then traded down as low as 1329.59 before catching a bid back up to the 1338.51 level. From there, profit taking and lingering debt fears pushed prices back down to close towards the lows of the day at 1331.94.

This kind of trading will persist as long as the US debt crisis remains unresolved. What we're seeing is panic driving futures lower leading to either a gap down in the indices or follow-through selling pushing down prices in the early morning. From there, dips are bought by large funds causing steep rallies in stocks and flat closes on the markets.

As the August 2 deadline approaches without a US debt deal passed, I expect investor jitters to increase as well as volatility in the markets. This was evident today as prices sold off sharply into the close--no doubt traders are looking to protect profits into the after-market session. But as I've mentioned in previous posts, I'm anticipating a relief rally on stocks once an agreement is inevitably made between the two US political parties.

On the daily chart, not much has changed since yesterday. We're still consolidating within Thursday's sharp move up and are trading above the 20 moving average and several key Fibonacci support levels. Assuming a deal is reached before the deadline, and prices don't sell-off, an agreement is the perfect catalyst to cause a rally up from this consolidation pattern and possibly even a hit of the 52 week highs towards 1370.

Tomorrow will be another mixed bag as the market digests a combination of positive earnings and debt fears. As these factors will effectively cancel out any momentum in either direction, I'm not expecting much action aide from intraday whips.

Be sure to check this blog daily and follow me on twitter for my latest thoughts on the market.

|

| Whips on the SPY 10 min continue during Tuesday's trading |

This kind of trading will persist as long as the US debt crisis remains unresolved. What we're seeing is panic driving futures lower leading to either a gap down in the indices or follow-through selling pushing down prices in the early morning. From there, dips are bought by large funds causing steep rallies in stocks and flat closes on the markets.

As the August 2 deadline approaches without a US debt deal passed, I expect investor jitters to increase as well as volatility in the markets. This was evident today as prices sold off sharply into the close--no doubt traders are looking to protect profits into the after-market session. But as I've mentioned in previous posts, I'm anticipating a relief rally on stocks once an agreement is inevitably made between the two US political parties.

On the daily chart, not much has changed since yesterday. We're still consolidating within Thursday's sharp move up and are trading above the 20 moving average and several key Fibonacci support levels. Assuming a deal is reached before the deadline, and prices don't sell-off, an agreement is the perfect catalyst to cause a rally up from this consolidation pattern and possibly even a hit of the 52 week highs towards 1370.

|

| Consolidation on the SPX could push prices higher in the coming days |

Tomorrow will be another mixed bag as the market digests a combination of positive earnings and debt fears. As these factors will effectively cancel out any momentum in either direction, I'm not expecting much action aide from intraday whips.

Be sure to check this blog daily and follow me on twitter for my latest thoughts on the market.

MCP explodes off of inverse head and shoulders pattern

It pays to trust trust charts and read technical patterns.

Yesterday I posted an alert to enter MCP long at or near the confirmed daily head and shoulders neckline. I entered this trade myself just prior to posting at 59.35. Today, the stock exploded to the upside and is now trading nearly 5 dollars above my entry price, up 7%.

The internet and media are buzzing with buyout rumours and general hype surrounding this stock, but none of it matters. Just read the charts, know the patterns and do what they tell you.

If you entered this trade, sell half at 66 and then set a breakeven stop for the rest of the position. The final target is 72-78, depending on how quickly it trades up.

Yesterday I posted an alert to enter MCP long at or near the confirmed daily head and shoulders neckline. I entered this trade myself just prior to posting at 59.35. Today, the stock exploded to the upside and is now trading nearly 5 dollars above my entry price, up 7%.

The internet and media are buzzing with buyout rumours and general hype surrounding this stock, but none of it matters. Just read the charts, know the patterns and do what they tell you.

If you entered this trade, sell half at 66 and then set a breakeven stop for the rest of the position. The final target is 72-78, depending on how quickly it trades up.

Labels:

case study,

follow-up,

mcp,

patterns,

swing,

trade idea

Monday, July 25, 2011

Markets continue to whip as debt negotiations stall

By this point it is cliched, but also accurate, to say that US debt ceiling negotiations are driving the markets. Events in the European Union, such as Greece's downgrade by Moody's last night, are now merely an afterthought to global traders--at least for the time being.

This morning the S&P 500 opened sharply lower as "bi-partisan" negotiations seemingly broke down over the weekend. But within 20 minutes of the opening bell, the S&P 500 easily started its climb back up to Friday's close at approximately 1345 on the SPX.

The day's rally lasted until midday, when the market topped at the gap-fill and started to decline, this time accelerated as US Republicans and Democrats traded barbs and publicly rejected each other's proposal. The drop continued for the rest of the session, with the SPX closing at 1337.43--more or less flat on the day.

Right now, the pattern on the daily SPX chart is the beginnings of bullish consolidation--a move up followed by several days of sideways trading within the range of the initial up-move. The longer we see sideways trading, the more likely that we eventually trade higher and approach the daily double top at 1370. This pattern confirms my suspicion that if a a debt resolution manages to pass the House and the Senate, the markets will rally as a sign of relief. And please note that the market does not care if it's a Republican or Democratic plan that passes, as long as this uncertainty comes to a timely end.

I have every confidence that a deal will pass by the deadline--to do otherwise without a contingency plan would be political suicide for all parties involved, not to mention the collateral damage to financial markets.

Going into the rest of the week, continue to follow the charts and consider news events only as a means of understanding the intraday whips of the market. We're still in an uptrend, though admittedly extended on the charts, and will remain so until we either hit resistance on the way up or break back to the downside. In the meantime, expect the whips and saws to continue until there is some sort of resolution.

This morning the S&P 500 opened sharply lower as "bi-partisan" negotiations seemingly broke down over the weekend. But within 20 minutes of the opening bell, the S&P 500 easily started its climb back up to Friday's close at approximately 1345 on the SPX.

|

| Market whips continue on the SPY 10 min chart |

The day's rally lasted until midday, when the market topped at the gap-fill and started to decline, this time accelerated as US Republicans and Democrats traded barbs and publicly rejected each other's proposal. The drop continued for the rest of the session, with the SPX closing at 1337.43--more or less flat on the day.

Right now, the pattern on the daily SPX chart is the beginnings of bullish consolidation--a move up followed by several days of sideways trading within the range of the initial up-move. The longer we see sideways trading, the more likely that we eventually trade higher and approach the daily double top at 1370. This pattern confirms my suspicion that if a a debt resolution manages to pass the House and the Senate, the markets will rally as a sign of relief. And please note that the market does not care if it's a Republican or Democratic plan that passes, as long as this uncertainty comes to a timely end.

I have every confidence that a deal will pass by the deadline--to do otherwise without a contingency plan would be political suicide for all parties involved, not to mention the collateral damage to financial markets.

Going into the rest of the week, continue to follow the charts and consider news events only as a means of understanding the intraday whips of the market. We're still in an uptrend, though admittedly extended on the charts, and will remain so until we either hit resistance on the way up or break back to the downside. In the meantime, expect the whips and saws to continue until there is some sort of resolution.

Trade idea: MCP long

MCP recently broke out of a perfect inverse head and shoulders pattern and could be due for a fairly big upside move. Inverse head and shoulders patterns have a high probability of playing out successfully.

The first target for this trade is $72, at which point I'll sell half and put in a break even stop. The final target is 78, just shy of the double top.

I entered this trade just prior to posting at approximately 59.35, but anywhere near the dotted blue neckline is a good entry. I will stop out on a daily close below this neckline.

The first target for this trade is $72, at which point I'll sell half and put in a break even stop. The final target is 78, just shy of the double top.

I entered this trade just prior to posting at approximately 59.35, but anywhere near the dotted blue neckline is a good entry. I will stop out on a daily close below this neckline.

|

| MCP inverse head and shoulders |

Sunday, July 24, 2011

Trade idea: TXN short

Texas Instruments (TXN) gapped down on July 11 and has since recovered, trading up significantly over the past week. If the stock fills this gap at 32.44, it should meet significant resistance.

In addition to a gap fill, this level also corresponds closely to a 61.8% fibonacci retracement and a previous pivot/area of congestion.

I'll look to enter this short trade on a break of the 32.44 gap fill area and will stop out on a daily close above the 50 moving average.

In addition to a gap fill, this level also corresponds closely to a 61.8% fibonacci retracement and a previous pivot/area of congestion.

I'll look to enter this short trade on a break of the 32.44 gap fill area and will stop out on a daily close above the 50 moving average.

Trade idea: MS short

MS has had a strong up-move over the past 4 trading days and is short term extended on the daily chart.

Should this stock continue to push up over the next few days, it will have good resistance between 25.50 and the 200 moving average. This level also corresponds to a 50% Fibonacci retracement.

I will look to take this trade on a break of 25.50 with a stop at a confirmed daily close above the 200 moving average.

Should this stock continue to push up over the next few days, it will have good resistance between 25.50 and the 200 moving average. This level also corresponds to a 50% Fibonacci retracement.

I will look to take this trade on a break of 25.50 with a stop at a confirmed daily close above the 200 moving average.

Saturday, July 23, 2011

Trade idea: Allstate (ALL) Short

In the event of further upside in the market next week, watch ALL for a pullback at 29.50. The stock has been in a significant downtrend since early May and is trading below its 20, 50 and 200 moving averages.

The 29.50 level corresponds to a gap fill and is very near to a pivot low and a 50% fibonacci retrace. Should this level break to the upside, there will be strong secondary resistance at the 20 moving average and the 61.8% fibonacci retrace.

I will look to short ALL on a break of 29.50 with a stop above the 20 moving average.

The 29.50 level corresponds to a gap fill and is very near to a pivot low and a 50% fibonacci retrace. Should this level break to the upside, there will be strong secondary resistance at the 20 moving average and the 61.8% fibonacci retrace.

I will look to short ALL on a break of 29.50 with a stop above the 20 moving average.

|

| ALL has strong resistance at the 29.50 level |

Thursday, July 21, 2011

Another big up-day for the SPX

The S&P 500 traded sharply higher today up nearly 18 points, or 1.35%. This rally came presumably on the back of good earnings reports and optimism that US debt ceiling negotiations may be close to an end. Progress in Europe in securing a bailout packages also helped to buoy prices.

Readers of this blog will know that I don't believe in fundamental explanations of market moves. As I've written numerous times, this 50 point rally we've seen so far since Monday is based simply on technicals and contrarian market psychology.

You'll recall from my previous posts that last week the market was oversold, overly-bearish and into technical support at a key 61.8% Fibonacci retracement level. Interestingly, traders last week and over the weekend were as bearish as they've been in years--this is what gave me the confidence to call not only for a pause but a significant bounce in prices this week.

Psychology plays an important role in determining the short term cycles of the market as big financial institutions look to shake out smaller traders from their short positions and devalue their put options. Once these same traders have been discouraged enough and become bulls, you can be sure the market will reverse and correct downwards. Combine this this contrarian psychology with good support and resistance levels and you will see powerful moves in the market.

If you were monitoring intraday trading on the SPY or any other major market index, you saw these concepts in action on a micro level. At approximately 12:40pm ET, the SPY rallied sharply on a rumour that debt negotiations had concluded, only to fall back sharply 10 minutes later on another rumour that a deal had not been reached. Both of these reports turned out to be either inaccurate or unsubstantiated and the SPY continued to trade upward as normal.

Going forward, I'm no longer strongly bullish although I think the likelihood of further upside tomorrow is reasonably high. I mentioned earlier this week to look for resistance at the 1340 and 1356 levels on the SPX. Today, we breezed through 1340 but 1356 should continue to act as resistance should we reach it. I may consider picking up some short positions if we reach 1356, but I will keep them small and maintain a tight stop.

Check back here regularly and follow me on twitter for my latest thoughts on the market.

Readers of this blog will know that I don't believe in fundamental explanations of market moves. As I've written numerous times, this 50 point rally we've seen so far since Monday is based simply on technicals and contrarian market psychology.

You'll recall from my previous posts that last week the market was oversold, overly-bearish and into technical support at a key 61.8% Fibonacci retracement level. Interestingly, traders last week and over the weekend were as bearish as they've been in years--this is what gave me the confidence to call not only for a pause but a significant bounce in prices this week.

|

| Monday's hit of 61.8 fib level leads to big bounce on SPX |

Psychology plays an important role in determining the short term cycles of the market as big financial institutions look to shake out smaller traders from their short positions and devalue their put options. Once these same traders have been discouraged enough and become bulls, you can be sure the market will reverse and correct downwards. Combine this this contrarian psychology with good support and resistance levels and you will see powerful moves in the market.

If you were monitoring intraday trading on the SPY or any other major market index, you saw these concepts in action on a micro level. At approximately 12:40pm ET, the SPY rallied sharply on a rumour that debt negotiations had concluded, only to fall back sharply 10 minutes later on another rumour that a deal had not been reached. Both of these reports turned out to be either inaccurate or unsubstantiated and the SPY continued to trade upward as normal.

|

| SPY 10 Min whips up and down then continues sideways |

Going forward, I'm no longer strongly bullish although I think the likelihood of further upside tomorrow is reasonably high. I mentioned earlier this week to look for resistance at the 1340 and 1356 levels on the SPX. Today, we breezed through 1340 but 1356 should continue to act as resistance should we reach it. I may consider picking up some short positions if we reach 1356, but I will keep them small and maintain a tight stop.

Check back here regularly and follow me on twitter for my latest thoughts on the market.

Wednesday, July 20, 2011

A day of rest for the markets

After a big move up or down, the market usually needs a day of rest before continuing on its way. Today was no exception as the S&P 500 traded mostly sideways and closed fractionally lower on the day.

Today's SPX candle is known as a doji--something created when the price trades within a narrow range throughout the day. A doji means indecision, and that's fitting considering the mix of good and bad economic and earnings news traders have been digesting over the past several days. I expect we'll see a continued move up tomorrow, but any surprise news regarding European or US debt issues overnight could complicate things.

As I explained yesterday, don't be distracted by earnings when trying to make sense of the bounce we're seeing. The current up-move is simply a factor of technical support and contrarian psychology. Continue to hold any longs you may have picked up and be sure to have breakeven stops for each of them.

I'll be watching closely as the charts unfold and will have good resistance levels as they approach.

Today's SPX candle is known as a doji--something created when the price trades within a narrow range throughout the day. A doji means indecision, and that's fitting considering the mix of good and bad economic and earnings news traders have been digesting over the past several days. I expect we'll see a continued move up tomorrow, but any surprise news regarding European or US debt issues overnight could complicate things.

As I explained yesterday, don't be distracted by earnings when trying to make sense of the bounce we're seeing. The current up-move is simply a factor of technical support and contrarian psychology. Continue to hold any longs you may have picked up and be sure to have breakeven stops for each of them.

I'll be watching closely as the charts unfold and will have good resistance levels as they approach.

Tuesday, July 19, 2011

You Win Some, You Don't Lose Some

I’ve only been writing here a few weeks, but this isn’t the first--and won’t be the last--time I mention the importance of setting stops and sticking to them. This surely isn’t a novel concept and is highlighted in any good 'Trading 101' book or program. If you always abide by your stops, I applaud you, and you're probably well on your way to being profitable. But I know some beginners read this blog, so I'm going to add my voice (and today's example) to the many telling you why stopping out is such a critical component of successful trading.

As I have reported, before today I had been holding FTS.to short and HSD.to, a 2x short ETF of the SPY, long. They were working well for me, and I had set what I hoped were reasonable targets. However, I never enter a trade without knowing not only where I want to exit (my target), but also where I need to exit if things go bad (my stop). Pre-market today, it was clear that these were going to hit my stop out levels. So I set my order, and when they were triggered almost immediately at the open, I wasn't overjoyed. But I also hadn't lost money, so I wasn't unhappy, stressed, or in the hole.

Given the rally today, I am quite happy to be out of these shorts. Would I have liked to make money on those positions? Obviously--you hope to profit on every trade. But that's not possible. The next best thing is to never lose money.

It's especially tempting to hold on to positions now that I am blogging - trades that go against me are now public. But that is all the more reason to show that I stick to my rules. So if you are a beginner, this one post may not make you to abide by your stops, but I hope it helps you on your journey. I'm not perfect, and I'm well aware of wanting to hold on to that position just one more day to give it a chance to turn around. I know when I first started trading I always had good intentions but didn't necessarily know how to follow through on them, and of course I'm human so I still make mistakes. So I will try periodically try to come back to this topic, because it's something that even experienced traders like myself can't hear too often.

"Surprise" rally crushes bears

Today the markets rallied sharply, catching quite a few traders off-guard. But for anyone who reads this blog or follows me on twitter, it shouldn't have come as a surprise.

Yesterday and late last week I called for a bounce based on technical support and market psychology. Today's trading shows me that I couldn't have been more correct.

The SPY opened the session up at 131.34 and then pushed further as high as 132.89. As you can see, the 61.8% fibbonacci level from yesterday held beautifully and today we saw more follow-through to the upside. The fact that so many traders are/were bearish I'm sure helped to propel prices as they got squeezed out of their positions.

Do not be distracted by all the talk of good earnings, etc. This is still a weak market with lots of underlying problems and will continue to be so for the foreseeable future. This is simply a relief bounce based on good technical support and a contrarian move to punish traders who over-shorted the market. Rest assured that prices will eventually fall back down just as quickly as we saw them rise today, but until that time we will enjoy the ride up.

I'll continue to look for more follow-through upside into this week. Any long positions should do well as this rally appears to be broad-based.

I'll keep this update brief as there is little to discuss. Assuming we continue up tomorrow, look to start taking profits first at the 1340 level and then at 1355 on the SPX.

Yesterday and late last week I called for a bounce based on technical support and market psychology. Today's trading shows me that I couldn't have been more correct.

|

| Nothing but upside since yesterday afternoon on SPY 10 min |

The SPY opened the session up at 131.34 and then pushed further as high as 132.89. As you can see, the 61.8% fibbonacci level from yesterday held beautifully and today we saw more follow-through to the upside. The fact that so many traders are/were bearish I'm sure helped to propel prices as they got squeezed out of their positions.

Do not be distracted by all the talk of good earnings, etc. This is still a weak market with lots of underlying problems and will continue to be so for the foreseeable future. This is simply a relief bounce based on good technical support and a contrarian move to punish traders who over-shorted the market. Rest assured that prices will eventually fall back down just as quickly as we saw them rise today, but until that time we will enjoy the ride up.

I'll continue to look for more follow-through upside into this week. Any long positions should do well as this rally appears to be broad-based.

|

| Huge bounce off of 61.8 fib level with follow-through today |

I'll keep this update brief as there is little to discuss. Assuming we continue up tomorrow, look to start taking profits first at the 1340 level and then at 1355 on the SPX.

Monday, July 18, 2011

Monday Market Summary

Today the markets saw some sharp selling as European and US debt fears continue to irk traders. The SPY opened at 131.08 and fell as low as 129.63 before recovering to close at 130.61.

Despite this selling, I continue to hold a slight upside bias for the short term. I think the markets are currently oversold and that the debt fear premium has been priced in for the most part already. The SPX broke the daily 20 moving average but still should have some short term support at the 61.8 Fibonacci retrace.

I still continue to hold a small position short the SPY via the HSD.to 2x ETF, as well as another small short in FTS.to. On the long side, I have a position in GIL.to based on the hit of the double bottom at 31.79 and another position in PG based on bullish consolidation above the 20 moving average.

Going forward into the week, I'll be watching the news and futures closely pre-market and after-hours. Debt negotiations in the US have overshadowed issues in Europe for the time being and traders are watching it with full attention. The market has priced in a lengthy, last minute agreement between Republican and Democrats which means an early resolution will cause a rally and no resolution will cause a fall. No debt resolution is a very unlikely scenario, in my opinion.

Tonight I'll be scanning for long setups in the event that we bounce as I expect we will. If we break lower, I'll simply look to buy stocks at the next set of levels down on the charts.

|

| Big drop and nice recovery on SPY 10 min |

Despite this selling, I continue to hold a slight upside bias for the short term. I think the markets are currently oversold and that the debt fear premium has been priced in for the most part already. The SPX broke the daily 20 moving average but still should have some short term support at the 61.8 Fibonacci retrace.

|

| Good bounce off 61.8 fib on SPX daily |

I still continue to hold a small position short the SPY via the HSD.to 2x ETF, as well as another small short in FTS.to. On the long side, I have a position in GIL.to based on the hit of the double bottom at 31.79 and another position in PG based on bullish consolidation above the 20 moving average.

Going forward into the week, I'll be watching the news and futures closely pre-market and after-hours. Debt negotiations in the US have overshadowed issues in Europe for the time being and traders are watching it with full attention. The market has priced in a lengthy, last minute agreement between Republican and Democrats which means an early resolution will cause a rally and no resolution will cause a fall. No debt resolution is a very unlikely scenario, in my opinion.

Tonight I'll be scanning for long setups in the event that we bounce as I expect we will. If we break lower, I'll simply look to buy stocks at the next set of levels down on the charts.

Saturday, July 16, 2011

AMGN Bounce Level

AMGN is very close to key support and if the market holds up next week it may bounce.

The 54.70 level corresponds to a gap fill and a 61.8% Fibonacci retrace. I'd consider taking this trade on a hit of this level with a confirmation stop just below it. If this level breaks, there will be secondary support at the pivot low of 53.16. This trade is somewhat higher risk due to the precipitous fall it has seen recently, but could bounce as it's very oversold.

If the level holds, look to take profits at the 200 moving average and use a trailing/breakeven stop thereafter.

Please be advised that if the market looks to fall early next week, I will not take this trade. Always be aware of overall market conditions when taking any trade and never fight the market.

The 54.70 level corresponds to a gap fill and a 61.8% Fibonacci retrace. I'd consider taking this trade on a hit of this level with a confirmation stop just below it. If this level breaks, there will be secondary support at the pivot low of 53.16. This trade is somewhat higher risk due to the precipitous fall it has seen recently, but could bounce as it's very oversold.

If the level holds, look to take profits at the 200 moving average and use a trailing/breakeven stop thereafter.

|

| AMGN may bounce if market holds |

Please be advised that if the market looks to fall early next week, I will not take this trade. Always be aware of overall market conditions when taking any trade and never fight the market.

In Sickness and in Wealth

If you’ve been following this blog, you know I like to post my market updates shortly after each day’s close--and you might also have noticed that Friday conspicuously had no such update. When you work for yourself, there is no point in making excuses--lying to the boss is lying to yourself. But there is also no point in not analyzing yourself--to be able to trade well is to know yourself--or taking learning opportunities wherever they present themselves. My own crashing yesterday after a long week is one such opportunity.

To succeed in this business you need to know your limits, and you need to take care of your health, both physically, mentally and emotionally. On top of my regular trading, I have added the task of creating this blog that I hope will be worthwhile to readers. That coupled with some personal issues and too many nights of fast food, and I ended the week with a whimper, not a bang. I need to learn that there is a limit to how far I can push myself.

Friday/Saturday Market Summary

Trading on Friday ended with a small push up into the close. This wasn't entirely unexpected as Friday's tend to see less trader participation later in the day and that typically favours the upside.

Readers of this blog know that I've been calling for downside since last week, even in the face of the big rally we saw that brought us nearly to daily all-time highs on the SPY. That prediction ended up being a good one as last's weeks trading has been almost exclusively to the downside. As of now, the market remains weak and in my opinion will continue to be so as long as debt issues in the United States and the European Union persist.

With that being said, it may come as a surprise to some that I'm slightly in favour of some short term upside in the market. My reasoning here is partly based on technicals and partly on market psychology.

On the technical side, the SPX is into some support at a back-test of the blue trendline. This is the same trendline that I expected to be resistance on the way up in late June. Clearly, this was not the case as we surged through it during the Independence Day/Canada Day holiday period. This level also coincides with a 50% Fibonacci retrace and the 20 daily moving average. In addition, the overall chart pattern on the SPX is a bullish wedge/flag/pullback pattern.

On the psychology side, the average trader out there is incredibly bearish at the moment. This isn't a surprise considering the scary macro-economic issues facing the world right now. But as a contrarian trader and marketician, this tells me that the market could be due for a short term bounce as the big financial players look to shake out those who've positioned themselves too heavily on the short side.

In any case, it's important for readers to understand that I'm neither strongly bullish nor bearish at this point. I'm simply suggesting that the market may be due for a short term bounce before continuing back to the downside. However, if there are any negative developments in either the US or EU debt problems over the weekend, it's quite possible that we break through support levels and continue to correct downwards.

I'll be monitoring the news and futures over the weekend. Follow me on Twitter (@thetsxpert) and check this blog regularly for my latest thoughts and analysis.

Readers of this blog know that I've been calling for downside since last week, even in the face of the big rally we saw that brought us nearly to daily all-time highs on the SPY. That prediction ended up being a good one as last's weeks trading has been almost exclusively to the downside. As of now, the market remains weak and in my opinion will continue to be so as long as debt issues in the United States and the European Union persist.

With that being said, it may come as a surprise to some that I'm slightly in favour of some short term upside in the market. My reasoning here is partly based on technicals and partly on market psychology.

On the technical side, the SPX is into some support at a back-test of the blue trendline. This is the same trendline that I expected to be resistance on the way up in late June. Clearly, this was not the case as we surged through it during the Independence Day/Canada Day holiday period. This level also coincides with a 50% Fibonacci retrace and the 20 daily moving average. In addition, the overall chart pattern on the SPX is a bullish wedge/flag/pullback pattern.

|

| SPX has support within a bullish wedge pattern. Does it bounce? |

On the psychology side, the average trader out there is incredibly bearish at the moment. This isn't a surprise considering the scary macro-economic issues facing the world right now. But as a contrarian trader and marketician, this tells me that the market could be due for a short term bounce as the big financial players look to shake out those who've positioned themselves too heavily on the short side.

In any case, it's important for readers to understand that I'm neither strongly bullish nor bearish at this point. I'm simply suggesting that the market may be due for a short term bounce before continuing back to the downside. However, if there are any negative developments in either the US or EU debt problems over the weekend, it's quite possible that we break through support levels and continue to correct downwards.

I'll be monitoring the news and futures over the weekend. Follow me on Twitter (@thetsxpert) and check this blog regularly for my latest thoughts and analysis.

Thursday, July 14, 2011

Thursday Market Summary

Today's trading was very much reminiscent of yesterday's. The SPY opened just about flat then rallied and ultimately fell to make new lows on the day.

The take-away from this is that the market remains in an extremely weak position and will continue be this way until the US and EU debt crises get some kind of (temporary) resolution. Until that time, or until we're in a stronger technical position, it appears that every rally will be sold into.

From a daily chart perspective, today we came very close to my 20MA average target, which today is at approximately 131.63. I may regret not covering my short position there as sometimes a near hit is as good as an actual one, but I think this market remains weak so I'm not worried going forward into the next few days. Also, please note the bear flag that is potentially playing out based on the last 5 days of trading followed by today's down-move.

Intraday, the SPY opened at 132.17--a huge recovery from the dump on the futures last night, which at one point was down over 10 points. From there, the SPY traded as high as 132.78 before falling all the way down to 130.68. After hitting these lows, the SPY got a big bounce back up as high as 131.70 and then all the way back down to 130.75 before chopping sideways for the rest of the day. The SPY closed the day at 130.93, down 0.69%.

Something else of interest I'd like to point out here is the massive intraday ranges we're starting to see, while never closing that far away from the open. This ends up making what's known as doji candles on the daily chart and can make swing trading a position over several days somewhat frustrating. On the other hand, it makes for a fantastic day trading environment.

Tomorrow will be very telling as we'll have a better idea if this breakdown will persist or if the market will rally off of daily support levels into Friday and next week. Be sure to check back here and follow me on Twitter for my latest analysis. I expect to have some actionable levels and trade setups very soon.

The take-away from this is that the market remains in an extremely weak position and will continue be this way until the US and EU debt crises get some kind of (temporary) resolution. Until that time, or until we're in a stronger technical position, it appears that every rally will be sold into.

From a daily chart perspective, today we came very close to my 20MA average target, which today is at approximately 131.63. I may regret not covering my short position there as sometimes a near hit is as good as an actual one, but I think this market remains weak so I'm not worried going forward into the next few days. Also, please note the bear flag that is potentially playing out based on the last 5 days of trading followed by today's down-move.

|

| SPY daily bear flag breaking down? |

Intraday, the SPY opened at 132.17--a huge recovery from the dump on the futures last night, which at one point was down over 10 points. From there, the SPY traded as high as 132.78 before falling all the way down to 130.68. After hitting these lows, the SPY got a big bounce back up as high as 131.70 and then all the way back down to 130.75 before chopping sideways for the rest of the day. The SPY closed the day at 130.93, down 0.69%.

|

| Massive range on SPY 10 min chart |

Something else of interest I'd like to point out here is the massive intraday ranges we're starting to see, while never closing that far away from the open. This ends up making what's known as doji candles on the daily chart and can make swing trading a position over several days somewhat frustrating. On the other hand, it makes for a fantastic day trading environment.

Tomorrow will be very telling as we'll have a better idea if this breakdown will persist or if the market will rally off of daily support levels into Friday and next week. Be sure to check back here and follow me on Twitter for my latest analysis. I expect to have some actionable levels and trade setups very soon.

Wednesday, July 13, 2011

Wednesday Market Summary

If you read my market summary from yesterday, I outlined a few scenarios we could expect going into today. Of those scenarios, I thought a big rally was the least likely and this is exactly what we got--initially. As I watched my screen this morning, I was a bit surprised to put it mildly.

The culprit for the rally was Ben Bernanke who today announced that IF certain economic trends persist (namely, slow growth) then further economic stimulus MIGHT be necessary. He also indicated that the Federal Reserve would be willing to step in and provide said stimulus, though he gave no firm commitment.

Be sure to read the write-up on this I posted to the blog earlier today.

In any case, I'll continue to trade the technicals and right now we're still in a middle range on the major indices. I'm still holding a couple of small short positions from last week which I'll continue to hold until we reach my target (20MA on SPY daily) or I get stopped out. But until we have a clear direction on this market, I'm very hesitant to initiate any new long or short plays. So far, the SPY has bounced off of daily support levels after the down-move of late last week and early this week. Technically, this is just a bear flag so I'll continue to maintain a downside bias.

Intraday, the SPY was all over the map. It opened the day at 132.09, up considerably from yesterday's close of 131.40. From there, the announcement from Bernanke sent it all the way up to 133.22, after which it had a steep fall back down to 131.52 before getting a small bounce into the close. The SPY ended the day closing at 131.84. This was very much a repeat performance of yesterday, just with more volatility.

Stay tuned to this blog and to my twitter feed as I keep you updated on this market. I know it's been quiet here in terms of giving out trade setups, but I have a feeling things should start to heat up once we hit key levels. I'll continue to let the charts be my guide and fill you all in as it happens.

The culprit for the rally was Ben Bernanke who today announced that IF certain economic trends persist (namely, slow growth) then further economic stimulus MIGHT be necessary. He also indicated that the Federal Reserve would be willing to step in and provide said stimulus, though he gave no firm commitment.

Be sure to read the write-up on this I posted to the blog earlier today.

In any case, I'll continue to trade the technicals and right now we're still in a middle range on the major indices. I'm still holding a couple of small short positions from last week which I'll continue to hold until we reach my target (20MA on SPY daily) or I get stopped out. But until we have a clear direction on this market, I'm very hesitant to initiate any new long or short plays. So far, the SPY has bounced off of daily support levels after the down-move of late last week and early this week. Technically, this is just a bear flag so I'll continue to maintain a downside bias.

|

| Two slight bounces after big down days on SPY |

Intraday, the SPY was all over the map. It opened the day at 132.09, up considerably from yesterday's close of 131.40. From there, the announcement from Bernanke sent it all the way up to 133.22, after which it had a steep fall back down to 131.52 before getting a small bounce into the close. The SPY ended the day closing at 131.84. This was very much a repeat performance of yesterday, just with more volatility.

|

| Fading the QE3 announcement |

Stay tuned to this blog and to my twitter feed as I keep you updated on this market. I know it's been quiet here in terms of giving out trade setups, but I have a feeling things should start to heat up once we hit key levels. I'll continue to let the charts be my guide and fill you all in as it happens.

Market Surges on QE3 Suggestion

Today Fed Chairman Ben Bernanke indicated that fiscal stimulus programs would be available in the future as needed, ala QE3. The SPY spiked sharply on this news as the US dollar dropped.

This should come as no surprise and is clearly the cause of yesterday's short-lived spike on the SPY at around 2pm ET. From my perspective, there is no way Ben Bernanke would ever say something the markets could interpret negatively. Fiscal stimulus comes in the form of soothing words just as often as it's monetary, and it's an area where the Fed has unlimited ammunition.

Prolonging the Fed's quantitative easing program means a weakened US dollar, and that will inflate the markets--just what we're seeing on the SPY intraday. It's unclear if this rally will hold, but a continually devalued US dollar will continue to push the markets up.

Despite all this seemingly bullish news, it's important to remember that Europe is still in trouble and those issues will not go away overnight. Any developments on this front (downgrades, defaults, etc...) will hit the Euro hard and therefore the markets.

In the event of a falling Euro and a rising US dollar, Ben Bernanke and his team at the Fed will have almost insurmountable task ahead of them in supporting this market. But until then, it's up up and away (for equities and commodities)!

|

| The Bernanke Effect |

This should come as no surprise and is clearly the cause of yesterday's short-lived spike on the SPY at around 2pm ET. From my perspective, there is no way Ben Bernanke would ever say something the markets could interpret negatively. Fiscal stimulus comes in the form of soothing words just as often as it's monetary, and it's an area where the Fed has unlimited ammunition.

Prolonging the Fed's quantitative easing program means a weakened US dollar, and that will inflate the markets--just what we're seeing on the SPY intraday. It's unclear if this rally will hold, but a continually devalued US dollar will continue to push the markets up.

Despite all this seemingly bullish news, it's important to remember that Europe is still in trouble and those issues will not go away overnight. Any developments on this front (downgrades, defaults, etc...) will hit the Euro hard and therefore the markets.

In the event of a falling Euro and a rising US dollar, Ben Bernanke and his team at the Fed will have almost insurmountable task ahead of them in supporting this market. But until then, it's up up and away (for equities and commodities)!

Tuesday, July 12, 2011

Lesson: Why I Never Trade Fundamentals

Today’s 10 minute SPY chart is a great illustration of why I trade technicals, not news. When the FOMC minutes this afternoon merely hinted at QE3, lots of fundamentals based (or, at least, fundamentally influenced) traders jumped on and went long. I watched this spike from the sidelines as there was no clear technical reason to buy there.

While hopefully some were lucky enough to get out for a quick scalp, many surely did not—and were burned when the news of Ireland's downgrade by Moody's brought the markets all the way back down to make new lows on the day. And to add insult to injury, the talk of QE3 turned out to be just a rumour anyways.

This shows one of the fundamental problems with fundamentals. News is by its very nature unpredictable and what I strive for as a technical trader is predictability. Fundamentals and news trades are ultimately traps for amateur investors to hand over their money to the big hedge funds and banks. And without a crystal ball, at what price do you buy and sell?

|

| Whip, meet saw. |

This shows one of the fundamental problems with fundamentals. News is by its very nature unpredictable and what I strive for as a technical trader is predictability. Fundamentals and news trades are ultimately traps for amateur investors to hand over their money to the big hedge funds and banks. And without a crystal ball, at what price do you buy and sell?

That’s why I let the charts be my crystal ball. Though obviously not perfect, with higher probability trades and good money management on your side, your odds of being successful go way up. Just be careful during earnings, options expiration, and other events that cause major moves. And if you keep your account flexible, you should be able to weather any unexpected fundamental news that comes your way.

Tuesday Market Summary

Today was very much the kind of day you'd expect after a big move up or down in the markets. Trading on the $SPY was interesting due to a few surprises, but was ultimately muted and confined to a range.

As a contrarian trader, I expect days like this. After yesterday's sharp drop, lots of amateur traders who read about it the night before piled on the short side this morning expecting to drop further. This is a perfect opportunity for the big financial players to whip the market around and stop these traders out. Also, keep in mind that this week is options expiration and erratic trading during this time is somewhat the norm.

Another reason why I expected this market pause is because of the technical support we hit at the daily 50 moving average on the SPY. Whenever you hit a major moving average or support level, you have to expect at least a small pause or bounce--just as I explained yesterday.

From an intraday perspective, the SPY opened the day down slightly at 131.69 and chopped sideways from there. The only surprise move came at 2pm ET when it was revealed that QE3 had been discussed as per the FOMC minutes. The SPY spiked almost 1 dollar on this news but shortly after it was announced that Ireland had been downgraded by Moody's to junk status and this brought the market all the way back in, going as low as 131.36. The SPY closed the day around the lows at 131.45--basically flat.

This is a good example of why I trade technicals and not fundamentals. Traders who bought the FOMC QE3 spike ended up giving back all their gains shortly after when Ireland was downgraded. For this reason, it's very important to follow the charts and only look to trade the best support and resistance levels. This strategy is crucial to avoiding the whips and saws of the market as much as possible.

Tomorrow is more of an unknown to me. Since we've satisfied the small pause/bounce requirement after yesterday's big move, Wednesday could either resume the down move or have another small up-day. The only scenario that would surprise me is a big move up. And of course, this assumes we don't get any other surprise news out of Europe overnight or pre-market.

Keep following this blog and my twitter feed for my latest thoughts. It will be interesting to see how the market digests Ireland's downgrade overnight. In the next few days I expect to have more long and short ideas on the market and in stocks. I just need

As a contrarian trader, I expect days like this. After yesterday's sharp drop, lots of amateur traders who read about it the night before piled on the short side this morning expecting to drop further. This is a perfect opportunity for the big financial players to whip the market around and stop these traders out. Also, keep in mind that this week is options expiration and erratic trading during this time is somewhat the norm.

Another reason why I expected this market pause is because of the technical support we hit at the daily 50 moving average on the SPY. Whenever you hit a major moving average or support level, you have to expect at least a small pause or bounce--just as I explained yesterday.

From an intraday perspective, the SPY opened the day down slightly at 131.69 and chopped sideways from there. The only surprise move came at 2pm ET when it was revealed that QE3 had been discussed as per the FOMC minutes. The SPY spiked almost 1 dollar on this news but shortly after it was announced that Ireland had been downgraded by Moody's to junk status and this brought the market all the way back in, going as low as 131.36. The SPY closed the day around the lows at 131.45--basically flat.

|

| News whips market up then right back down |

This is a good example of why I trade technicals and not fundamentals. Traders who bought the FOMC QE3 spike ended up giving back all their gains shortly after when Ireland was downgraded. For this reason, it's very important to follow the charts and only look to trade the best support and resistance levels. This strategy is crucial to avoiding the whips and saws of the market as much as possible.

Tomorrow is more of an unknown to me. Since we've satisfied the small pause/bounce requirement after yesterday's big move, Wednesday could either resume the down move or have another small up-day. The only scenario that would surprise me is a big move up. And of course, this assumes we don't get any other surprise news out of Europe overnight or pre-market.

Keep following this blog and my twitter feed for my latest thoughts. It will be interesting to see how the market digests Ireland's downgrade overnight. In the next few days I expect to have more long and short ideas on the market and in stocks. I just need

Monday, July 11, 2011

Don't Fight the Trend: A Lesson

When I first started trading, I had tunnel vision. I took what I learned about indicators and applied them one chart at a time. And while I had become fairly competent at charting, nothing ever worked out quite like I expected. I got caught in a frustrating loop: I’d see a setup and take it expecting a big move, but would only get a small one. I wouldn’t get out in time, and I’d end up stopping out. Not wanting to get burned the next time, I’d see a setup and take the first bump I got, only to see the stock continue to rise along with all the profits I wasn’t making.

Fortunately, money management kept me from losing big, but I also wasn’t making big. My technical analysis was missing a key component--I wasn’t paying attention to the overall market conditions.

If the markets are roaring, shorts are going to be more difficult to predict. If the markets are dropping, few stocks will buck the trend. That’s why now if I’m looking at an oil stock, you can bet that I’m also looking at crude oil, and the energy sectors in general. Or if a gold stock looks bullish but gold is in a down-trend, I’m going to think twice before going long.

If the markets are roaring, shorts are going to be more difficult to predict. If the markets are dropping, few stocks will buck the trend. That’s why now if I’m looking at an oil stock, you can bet that I’m also looking at crude oil, and the energy sectors in general. Or if a gold stock looks bullish but gold is in a down-trend, I’m going to think twice before going long.

Since I trade both Canadian and American stocks, my eyes are glued to the TSX 60 index, the S&P 500 and the US dollar at all times. I have to have as solid a grasp as possible on what is happening in all areas of the market before I make any move to make sure I'm not fighting a trend.

| |

| MFC.to had a nice bull flag setup but fell with the rest of the market |

This is why I didn’t buy MFC.to last week, despite its beautiful bull flag. What tipped me off was the fact that the TSX 60 index was incredibly extended and due for a pullback. This told me that going long any TSX listed stock would be like rowing a boat upstream--i.e., possible, but difficult and likely to fail.

So while this chart looked great by itself, it didn’t look great enough to fight the market, and sure enough it got a big pullback today along with everything else.

Major Down Move for the TSX 60

Last week I wondered if the TSX 60 had put in a pivot top or if it was merely consolidating sideways. Today the answer to that question is clear as the index traded sharply lower down 1.33%. This is a major reversal to the downside and indicates that for the time being we are in a weak, down-trending Canadian market.

Seeing this down-move is good in terms of gauging the direction of the market, but it's unclear if we'll see further selling or if this dip will be bought.

The TSX 60 will have some support at it's current levels around the 20MA, the 50% and the 61.8% fib retracements. Until we break these levels, it's possible that we at least see a small bounce before going lower. However, today's move down was a very big one and should limit any upside we may see.

As with the S&P 500, I'll be watching the TSX 60 very closely over the next few trading days. I hope to have actionable levels to swing trade very shortly, but until then follow the chart above as a guide to the nearest support and resistance levels.

Seeing this down-move is good in terms of gauging the direction of the market, but it's unclear if we'll see further selling or if this dip will be bought.

The TSX 60 will have some support at it's current levels around the 20MA, the 50% and the 61.8% fib retracements. Until we break these levels, it's possible that we at least see a small bounce before going lower. However, today's move down was a very big one and should limit any upside we may see.

|

| A pivot appears to be in on the TSX 60 |

Monday Market Summary

Today the markets opened sharply lower again after debt fears in Europe resurfaced during overnight trading. The latest worry is that Italy will be the next country to be downgraded and/or default.

The SPY opened this morning down $1.65 at 132.75 and went as low as 131.91 before getting a bounce back up to 132.50. From there the SPY traded back down and briefly touched 131.84, breaking the intraday double bottom and getting another small bounce. The SPY then traded lower again, hitting 131.66. From there the market traded mostly sideways for the rest of the day as is typical after a big move in any direction.

These European debt issues are and will continue to be a serious issue for the markets, but the fact remains that the major stock indices are severely overbought and overdue for a correction. As long as this remains the case, any news the markets interpret negatively will cause them to sell.

Technically speaking, a second down day in a row after such a big rally during the past two weeks is significant as it tells me we're definitely in a short term correction. The question now is how much more downside can we expect in the short term.

The 132 area is the first level of major support. This was the breakout area before the massive follow-through rally that began the week before last on Friday. Just below here at 131.50 is the 50MA on the daily chart. As long as the market can hold this area, it's possible that we bounce and recover, but if it breaks we may have a more serious correction at hand.

I'll be watching these levels closely this week. Hopefully after a few more days of trading we'll have a better idea of which levels are going to be good for an extended move, either long or short. Until then, especially during options expiration week, I expect to see whips up and down. Weeks like this make swing trading difficult and is better suited for shorter term day trading.

Keep checking back here for daily updates and follow me on twitter for my thoughts throughout the day.

The SPY opened this morning down $1.65 at 132.75 and went as low as 131.91 before getting a bounce back up to 132.50. From there the SPY traded back down and briefly touched 131.84, breaking the intraday double bottom and getting another small bounce. The SPY then traded lower again, hitting 131.66. From there the market traded mostly sideways for the rest of the day as is typical after a big move in any direction.

|

| SPY 10min traded down for the majority of the day |

These European debt issues are and will continue to be a serious issue for the markets, but the fact remains that the major stock indices are severely overbought and overdue for a correction. As long as this remains the case, any news the markets interpret negatively will cause them to sell.

Technically speaking, a second down day in a row after such a big rally during the past two weeks is significant as it tells me we're definitely in a short term correction. The question now is how much more downside can we expect in the short term.

The 132 area is the first level of major support. This was the breakout area before the massive follow-through rally that began the week before last on Friday. Just below here at 131.50 is the 50MA on the daily chart. As long as the market can hold this area, it's possible that we bounce and recover, but if it breaks we may have a more serious correction at hand.

|

| SPY daily will have support at dotted blue lines, resistance at double top |

I'll be watching these levels closely this week. Hopefully after a few more days of trading we'll have a better idea of which levels are going to be good for an extended move, either long or short. Until then, especially during options expiration week, I expect to see whips up and down. Weeks like this make swing trading difficult and is better suited for shorter term day trading.

Keep checking back here for daily updates and follow me on twitter for my thoughts throughout the day.

Sunday, July 10, 2011

Are Ag Stocks Ready to Pop?

After a good move on Friday, the market seems prepped for a possible further push up on agriculture stocks like POT.to. The bullish case being made is that people need to eat under any economic circumstances and therefore stocks like this are safe bets.

As a technical trader, I'm not concerned with bullish fundamentals unless there are technical factors suggesting the same. Fortunately, I see several on POT.to, Saskatchewan’s giant potash company, that suggest possible upside in the near future.

First, Friday's breakout up-move easily pushed through two pivot resistance levels--55.97 and 56.58. This alone is a bullish sign to be sure, but please note that the push up also brought the price above a crucial inverse head and shoulders neckline. What this tells me is that any retrace back down to the neckline (currently just below 55.50) is a good buy. However, a close back below the neckline negates the trade.

If POT.to keeps going up, there is no major resistance until 59.67 and 60.50. And if it is able to show this much strength, re-testing February’s highs might not be an unrealistic expectation. But, like always in tech analysis, this pattern has its caveats.

For starters, the left shoulder is not ideal as it is considerably smaller than the right shoulder. I like this pattern best when each shoulder is roughly the same size. This coupled with an overall market that is very extended makes me cautious about jumping on board just yet.

Also of relevance, check out AGU.to, another agriculture stock with a similar inverse head and shoulders pattern. The same rules apply to this trade--a re-test of the neckline is a buy and a close below it is a stop out. AGU.to will have resistance at the 88 and 93 pivot highs.

On either of these trades, please mind your stops. Both stocks will not have significant support until their moving averages several dollars below the necklines.

I may take either POT.to or AGU.to for a long swing on a re-test of the necklines, as outlined in the charts above. If you're already in these trades for any reason, just be sure to use a stop to protect your profits. Also, just to reiterate, please be aware that the market is incredibly extended. Any and all stocks are due for a pullback at any time, including these. This doesn't mean that a bullish pattern can't play out, it just means be careful.

Friday, July 8, 2011

New Sections: S&P 500 and TSX 60 Charts

I've added two new sections to this site: a daily chart analysis for both the S&P 500 and the TSX 60.

Each day I'll update these pages with a newly annotated chart and the major support and resistance levels. I'll also post a short commentary on where the charts stand and what I'm looking for going forward.

This will be in addition to the daily market summaries, trade setups and other articles I post on a regular basis. I'm adding these pages for ease of reference and gearing them for those who just want the most basic information at a glance. I plan to add other market indices soon.

You can find links to these sections on the menu bar at the top of every page.

Each day I'll update these pages with a newly annotated chart and the major support and resistance levels. I'll also post a short commentary on where the charts stand and what I'm looking for going forward.

This will be in addition to the daily market summaries, trade setups and other articles I post on a regular basis. I'm adding these pages for ease of reference and gearing them for those who just want the most basic information at a glance. I plan to add other market indices soon.

You can find links to these sections on the menu bar at the top of every page.

Friday Market Summary

Today the markets had their first significant down move in eight days. The drop came in the form of a gap down in the morning after an absolutely abysmal Nonfarm Payrolls report was released pre-market. Expectations were for an increase of 100,000 jobs while the data came in at a pathetic 18,000.

When the data was released, the futures dropped sharply and once the market opened the SPY gapped down by $1.53. The SPY then briefly flirted with the 200MA on the 10 min chart and ultimately floated back up upwards for the rest of the day closing at 134.40. This float up is not unexpected on a Friday and in a market with light volume.

Technically speaking today was significant as this massive rally finally took a hit. But while the market is down, it isn't out--yet. I'd like to see the SPY trade lower for at least one more day before I consider this anything more than a retrace with choppy consolidation of an up-move. With this said, yesterday's doji candle followed by today's sharply lower prices does suggest a top is in place for the time being.

Next week is a wildcard. It's the start of options expiration week and a slew of earnings reports are set to be released. There's also the ever-looming potential of bad news coming out of Europe regarding one or more of the debt issues that region is facing. The combination of all these factors means that there's a real possibility for volatile trading if anything catches the markets by surprise. And at such lofty levels on the charts, any volatility will likely equate to a move down.

Options expiration typically involves the market moving away from the most popular put and call strike prices. For example, if traders are weighted heavily in calls of a particular stock, it's not uncommon for the stock to move in the opposite direction so that those calls expire as cheaply as possible. This minimizes the amount that financial institutions would have to pay out in losses and makes it undesirable for the average trader to hold calls or puts long-term.