This weekend I posted that I'm expecting some short term upside on the major market indices based on sideways consolidation on their daily charts. My position remains unchanged as we've seen this scenario play out.

Yesterday the S&P 500 traded up sharply and today closed flat. If we see another one or two days of flat to moderate downside trading, I expect to see another leg up into resistance at the 1250 level. I will look to short a hit or break of this level as it will complete the macro bear wedge that's been forming on the daily chart.

If we don't see consolidation, either by a large move up or down this week, I will switch to a neutral bias on the markets and will not hold any overnight positions. Ideally, any consolidation will take place within the range of the large up move created by Monday's rally.

Showing posts with label long. Show all posts

Showing posts with label long. Show all posts

Tuesday, August 30, 2011

No change in outlook for S&P 500

Labels:

consolidation,

key levels,

long,

market summary,

SP500

Wednesday, August 17, 2011

Markets grind sideways setting up for possible move higher--then lower

The S&P 500 continued to grind sideways today, closing positive by just .09%. This is in line with my expectations as outlined in yesterday's post.

As long as this market trades sideways, the odds increase that we see a push higher in the coming days or early next week.

Please note that we are still trading within a macro bear wedge pattern signalling that the markets will ultimately trade lower whether or not we trade higher first. This means that we are looking at two trade setups within a single pattern: (1) bullish consolidation to push us higher into resistance and (2) a pullback from that resistance triggering the bear wedge.

Tomorrow, I will be looking for an additional day of consolidation before I am convinced of a move higher in the short term. If we break lower first, the bullish pattern will be negated and will trigger the bear wedge. And if we trade higher, as I suspect we might, I'll look for resistance at the fib levels in the chart above.

As long as this market trades sideways, the odds increase that we see a push higher in the coming days or early next week.

|

| Note the bear wedge pattern outlined in green arrows |

Please note that we are still trading within a macro bear wedge pattern signalling that the markets will ultimately trade lower whether or not we trade higher first. This means that we are looking at two trade setups within a single pattern: (1) bullish consolidation to push us higher into resistance and (2) a pullback from that resistance triggering the bear wedge.

Tomorrow, I will be looking for an additional day of consolidation before I am convinced of a move higher in the short term. If we break lower first, the bullish pattern will be negated and will trigger the bear wedge. And if we trade higher, as I suspect we might, I'll look for resistance at the fib levels in the chart above.

Monday, August 1, 2011

Trade idea: SM long

SM has pulled back over the past week after an impressive up-trend that began in mid June. If it pulls back further, look for support between 70.50 and 71.14.

This range corresponds to three support factors: a 50% fib retrace at 71.14, a previous pivot high at 70.46 and the 50 moving average currently at 70.38.

I will look to take this trade long on a hit or break of the 50 moving average or the pivot high at 70.46--whichever comes first.

This range corresponds to three support factors: a 50% fib retrace at 71.14, a previous pivot high at 70.46 and the 50 moving average currently at 70.38.

I will look to take this trade long on a hit or break of the 50 moving average or the pivot high at 70.46--whichever comes first.

Trade idea: WFC long

WFC will hit good support at 26.88 if it continues down over the next few days.

This level corresponds to a gap fill and an important up-sloping trendline.

I will consider entering this trade on a hit of the gap fill at 26.88 and will be watching closely for it to close above the blue trendline. The closer the two levels are to each other , the better the odds of a successful bounce--this is why it's preferable for the trade to trigger in the near future.

As always, use a stop.

This level corresponds to a gap fill and an important up-sloping trendline.

I will consider entering this trade on a hit of the gap fill at 26.88 and will be watching closely for it to close above the blue trendline. The closer the two levels are to each other , the better the odds of a successful bounce--this is why it's preferable for the trade to trigger in the near future.

As always, use a stop.

Trade idea: WAG long

Walgreen Co., (WAG) will have two important support levels coming up if it continues to decline.

The first level is at 36.68 and it corresponds to a gap fill and a 50% fib retrace. The second level at 34.71 corresponds to another gap fill and a 61.8% fib retrace.

As both of these levels have multiple support factors, both can be entered long for a short term swing trade. For either of these levels, be sure to use an appropriate stop and set it to trailing once in the money.

The first level is at 36.68 and it corresponds to a gap fill and a 50% fib retrace. The second level at 34.71 corresponds to another gap fill and a 61.8% fib retrace.

As both of these levels have multiple support factors, both can be entered long for a short term swing trade. For either of these levels, be sure to use an appropriate stop and set it to trailing once in the money.

Labels:

key levels,

long,

SP500,

swing trade,

trade idea,

WAG

Trade idea: USB long

USB will have significant support at around 25 dollars if it continues to drop into this week. This level corresponds to a major daily gap fill as well as the 50 moving average.

I will look to enter USB long on a hit or break of 25, though 25.30 will also have good support as it corresponds to a 61.8% fib retrace. I'll keep a stop at a daily close below 25--higher risk traders can put their stop below 24.15.

I will look to enter USB long on a hit or break of 25, though 25.30 will also have good support as it corresponds to a 61.8% fib retrace. I'll keep a stop at a daily close below 25--higher risk traders can put their stop below 24.15.

Sunday, July 31, 2011

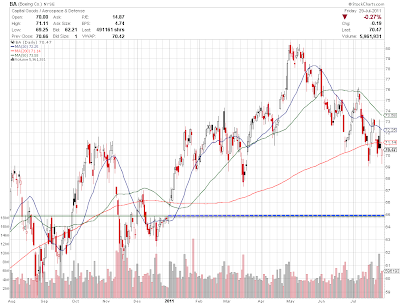

Trade idea: BA long

If BA slides into next week, it will hit an important support level at 64.88.

This level corresponds to a gap fill and is where the stock closed just before a sharp rally that has lasted into 2011. Market permitting, a hit of this level should lead to a significant bounce.

I will look to enter BA long on a hit or break of 64.88 and will stop out on a confirmed daily close just below. Traders willing to take on greater risk can put their stop below the nearby pivot low at 62.46.

This level corresponds to a gap fill and is where the stock closed just before a sharp rally that has lasted into 2011. Market permitting, a hit of this level should lead to a significant bounce.

I will look to enter BA long on a hit or break of 64.88 and will stop out on a confirmed daily close just below. Traders willing to take on greater risk can put their stop below the nearby pivot low at 62.46.

Saturday, July 30, 2011

Trade Idea: AEP long

If AEP trades down next week it will have strong support at 36.47, just below the current price.

This level has three factors to support a bounce: a previous pivot high, a gap fill and a 61.8% fibonacci retracement.

I will look to enter this trade long on a hit or break of 36.50, with a stop at a confirmed close below it. If by chance this level breaks, there will be strong secondary support at the 200 moving average.

This level has three factors to support a bounce: a previous pivot high, a gap fill and a 61.8% fibonacci retracement.

I will look to enter this trade long on a hit or break of 36.50, with a stop at a confirmed close below it. If by chance this level breaks, there will be strong secondary support at the 200 moving average.

Trade Idea: AA long levels

If Alcoa Inc. (AA) continues down next week, it will find support at two important levels. Both of these levels combine multiple support factors and so have a high probability of bouncing.

The first level is at 14.18 which corresponds with a previous pivot high and a 50% fibonacci retracement. The second level is at 13.16--the confluence of a 61.8% fibonacci retracement and the nearby gap fill at 13.10.

I will look to enter AA long on a break of 14.18 with a stop at a confirmed daily close just below it. If this level breaks, I will enter long again at 13.10.

As with any trade, remember to take partial profits early and use a break-even stop thereafter.

The first level is at 14.18 which corresponds with a previous pivot high and a 50% fibonacci retracement. The second level is at 13.16--the confluence of a 61.8% fibonacci retracement and the nearby gap fill at 13.10.

I will look to enter AA long on a break of 14.18 with a stop at a confirmed daily close just below it. If this level breaks, I will enter long again at 13.10.

As with any trade, remember to take partial profits early and use a break-even stop thereafter.

Monday, July 25, 2011

Trade idea: MCP long

MCP recently broke out of a perfect inverse head and shoulders pattern and could be due for a fairly big upside move. Inverse head and shoulders patterns have a high probability of playing out successfully.

The first target for this trade is $72, at which point I'll sell half and put in a break even stop. The final target is 78, just shy of the double top.

I entered this trade just prior to posting at approximately 59.35, but anywhere near the dotted blue neckline is a good entry. I will stop out on a daily close below this neckline.

The first target for this trade is $72, at which point I'll sell half and put in a break even stop. The final target is 78, just shy of the double top.

I entered this trade just prior to posting at approximately 59.35, but anywhere near the dotted blue neckline is a good entry. I will stop out on a daily close below this neckline.

|

| MCP inverse head and shoulders |

Thursday, July 21, 2011

Another big up-day for the SPX

The S&P 500 traded sharply higher today up nearly 18 points, or 1.35%. This rally came presumably on the back of good earnings reports and optimism that US debt ceiling negotiations may be close to an end. Progress in Europe in securing a bailout packages also helped to buoy prices.

Readers of this blog will know that I don't believe in fundamental explanations of market moves. As I've written numerous times, this 50 point rally we've seen so far since Monday is based simply on technicals and contrarian market psychology.

You'll recall from my previous posts that last week the market was oversold, overly-bearish and into technical support at a key 61.8% Fibonacci retracement level. Interestingly, traders last week and over the weekend were as bearish as they've been in years--this is what gave me the confidence to call not only for a pause but a significant bounce in prices this week.

Psychology plays an important role in determining the short term cycles of the market as big financial institutions look to shake out smaller traders from their short positions and devalue their put options. Once these same traders have been discouraged enough and become bulls, you can be sure the market will reverse and correct downwards. Combine this this contrarian psychology with good support and resistance levels and you will see powerful moves in the market.

If you were monitoring intraday trading on the SPY or any other major market index, you saw these concepts in action on a micro level. At approximately 12:40pm ET, the SPY rallied sharply on a rumour that debt negotiations had concluded, only to fall back sharply 10 minutes later on another rumour that a deal had not been reached. Both of these reports turned out to be either inaccurate or unsubstantiated and the SPY continued to trade upward as normal.

Going forward, I'm no longer strongly bullish although I think the likelihood of further upside tomorrow is reasonably high. I mentioned earlier this week to look for resistance at the 1340 and 1356 levels on the SPX. Today, we breezed through 1340 but 1356 should continue to act as resistance should we reach it. I may consider picking up some short positions if we reach 1356, but I will keep them small and maintain a tight stop.

Check back here regularly and follow me on twitter for my latest thoughts on the market.

Readers of this blog will know that I don't believe in fundamental explanations of market moves. As I've written numerous times, this 50 point rally we've seen so far since Monday is based simply on technicals and contrarian market psychology.

You'll recall from my previous posts that last week the market was oversold, overly-bearish and into technical support at a key 61.8% Fibonacci retracement level. Interestingly, traders last week and over the weekend were as bearish as they've been in years--this is what gave me the confidence to call not only for a pause but a significant bounce in prices this week.

|

| Monday's hit of 61.8 fib level leads to big bounce on SPX |

Psychology plays an important role in determining the short term cycles of the market as big financial institutions look to shake out smaller traders from their short positions and devalue their put options. Once these same traders have been discouraged enough and become bulls, you can be sure the market will reverse and correct downwards. Combine this this contrarian psychology with good support and resistance levels and you will see powerful moves in the market.

If you were monitoring intraday trading on the SPY or any other major market index, you saw these concepts in action on a micro level. At approximately 12:40pm ET, the SPY rallied sharply on a rumour that debt negotiations had concluded, only to fall back sharply 10 minutes later on another rumour that a deal had not been reached. Both of these reports turned out to be either inaccurate or unsubstantiated and the SPY continued to trade upward as normal.

|

| SPY 10 Min whips up and down then continues sideways |

Going forward, I'm no longer strongly bullish although I think the likelihood of further upside tomorrow is reasonably high. I mentioned earlier this week to look for resistance at the 1340 and 1356 levels on the SPX. Today, we breezed through 1340 but 1356 should continue to act as resistance should we reach it. I may consider picking up some short positions if we reach 1356, but I will keep them small and maintain a tight stop.

Check back here regularly and follow me on twitter for my latest thoughts on the market.

Saturday, July 16, 2011

AMGN Bounce Level

AMGN is very close to key support and if the market holds up next week it may bounce.

The 54.70 level corresponds to a gap fill and a 61.8% Fibonacci retrace. I'd consider taking this trade on a hit of this level with a confirmation stop just below it. If this level breaks, there will be secondary support at the pivot low of 53.16. This trade is somewhat higher risk due to the precipitous fall it has seen recently, but could bounce as it's very oversold.

If the level holds, look to take profits at the 200 moving average and use a trailing/breakeven stop thereafter.

Please be advised that if the market looks to fall early next week, I will not take this trade. Always be aware of overall market conditions when taking any trade and never fight the market.

The 54.70 level corresponds to a gap fill and a 61.8% Fibonacci retrace. I'd consider taking this trade on a hit of this level with a confirmation stop just below it. If this level breaks, there will be secondary support at the pivot low of 53.16. This trade is somewhat higher risk due to the precipitous fall it has seen recently, but could bounce as it's very oversold.

If the level holds, look to take profits at the 200 moving average and use a trailing/breakeven stop thereafter.

|

| AMGN may bounce if market holds |

Please be advised that if the market looks to fall early next week, I will not take this trade. Always be aware of overall market conditions when taking any trade and never fight the market.

Sunday, July 10, 2011

Are Ag Stocks Ready to Pop?

After a good move on Friday, the market seems prepped for a possible further push up on agriculture stocks like POT.to. The bullish case being made is that people need to eat under any economic circumstances and therefore stocks like this are safe bets.

As a technical trader, I'm not concerned with bullish fundamentals unless there are technical factors suggesting the same. Fortunately, I see several on POT.to, Saskatchewan’s giant potash company, that suggest possible upside in the near future.

First, Friday's breakout up-move easily pushed through two pivot resistance levels--55.97 and 56.58. This alone is a bullish sign to be sure, but please note that the push up also brought the price above a crucial inverse head and shoulders neckline. What this tells me is that any retrace back down to the neckline (currently just below 55.50) is a good buy. However, a close back below the neckline negates the trade.

If POT.to keeps going up, there is no major resistance until 59.67 and 60.50. And if it is able to show this much strength, re-testing February’s highs might not be an unrealistic expectation. But, like always in tech analysis, this pattern has its caveats.

For starters, the left shoulder is not ideal as it is considerably smaller than the right shoulder. I like this pattern best when each shoulder is roughly the same size. This coupled with an overall market that is very extended makes me cautious about jumping on board just yet.

Also of relevance, check out AGU.to, another agriculture stock with a similar inverse head and shoulders pattern. The same rules apply to this trade--a re-test of the neckline is a buy and a close below it is a stop out. AGU.to will have resistance at the 88 and 93 pivot highs.

On either of these trades, please mind your stops. Both stocks will not have significant support until their moving averages several dollars below the necklines.

I may take either POT.to or AGU.to for a long swing on a re-test of the necklines, as outlined in the charts above. If you're already in these trades for any reason, just be sure to use a stop to protect your profits. Also, just to reiterate, please be aware that the market is incredibly extended. Any and all stocks are due for a pullback at any time, including these. This doesn't mean that a bullish pattern can't play out, it just means be careful.

Friday, July 1, 2011

Key level: MCHP Short

MCHP is into strong resistance at the current levels. When the market pulls back, this stock should as well. I will consider shorting this stock if it pushes back to today's highs, otherwise I'll keep it on watch for next week.

There are five resistance factors here: the 50MA, gap fill, bear flag, 50% fib and a previous pivot.Good short between 38.34 and 38.67. I'll look to enter at 38.67.

There are five resistance factors here: the 50MA, gap fill, bear flag, 50% fib and a previous pivot.Good short between 38.34 and 38.67. I'll look to enter at 38.67.

Monday, June 27, 2011

Key levels: FTS.to Long

Fortis is a chart I wish I had been paying closer attention to on Friday. It fell into key support @ 30.75, which corresponds to a previous pivot low and a long term 38.2% fibonacci level. I like that it's holding the blue trend-line as well.

I will enter FTS.to for a swing long at a retest of friday's lows @ 30.79. I will also consider going long if today's daily chart looks to close with a doji candlestick. A doji is formed when the price closes flat on the day after going both higher and lower.

Of course, any sharp downturn in the overall market will negate this trade.

Update: Fortis closed well above the support levels I mentioned. I'll now look to enter on a hit of the next level down, $30.

I will enter FTS.to for a swing long at a retest of friday's lows @ 30.79. I will also consider going long if today's daily chart looks to close with a doji candlestick. A doji is formed when the price closes flat on the day after going both higher and lower.

Of course, any sharp downturn in the overall market will negate this trade.

Update: Fortis closed well above the support levels I mentioned. I'll now look to enter on a hit of the next level down, $30.

Subscribe to:

Posts (Atom)