Today the S&P 500 ended flat. This isn't surprising as the market is incredibly extended right now since bouncing in mid June. Even with light volume the market needed a day of rest before going up or down any further.

Yesterday I wondered if the market would go up or pullback today. The signals the market gave us are mixed and require some analysis. Going forward into the rest of the week I think there is an almost equal case to be made for either further upside or a small pullback.

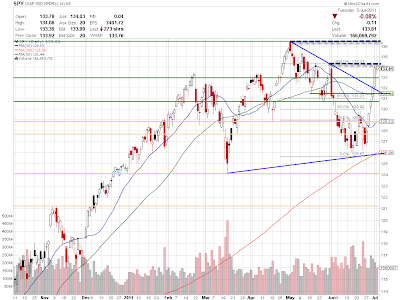

The SPY ended flat and even had a float into the close. Today's daily candlestick ended in the form of a doji. Under the right circumstances, a doji hints at a possible reversal in trend. Idealy, I like to see doji candles form right underneath resistance levels after a extended move--this setup is usually a good short entry for a pullback. We got the extended move and the doji today, but still didn't quite hit the next resistance level at 134.30.

Based on this last candle, there are a few of scenarios that could play out tomorrow. First, the extended move plus a doji could lead to a reversal. In my opinion, this is the healthiest move as we're very extended and it's difficult to go long or short stocks at these intermediate prices.

Alternatively, if we push up into the next resistance pivot at 134.30 we could pull back from there. I will be watching this closely if it's the case as we came very close to hitting this level today and that slightly lowers the odds of it being resistance when it actually hits.

The third option sees us forming a second doji candle on the daily chart. This option is the trickiest because it's still possible to have a pullback, but two sideways days after an up day is very close to creating a bull flag consolidation pattern and hints that there may be further upside still. In this case, we'd probably push all the way back up to the double top. If this ends up being the case, I may decide to cover my shorts just before the close tomorrow just in case.

With these three scenarios in mind, I will be preparing my trades for tomorrow. As the holiday weekend fades, volume should start to re-enter the market and volatility will increase. I'm confident that soon we'll get a move in the market one way or the other and tomorrow might be that day. I'll be watching the futures overnight as that should give us a clue to what might happen.

No comments:

Post a Comment