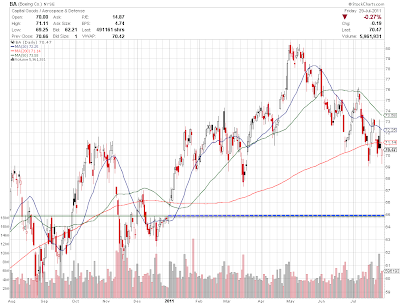

If you connect the last two pivot highs, you form a trendline that stretches all the way back to late 2008. The third hit of any trendline is usually a high probability short, especially when they're as nicely spaced as on the chart below.

Treasuries often trade contrary to stocks as institutional investors look for refuge in seemingly safer assets. Note the vertical lines in the S&P 500 weekly chart below--this is where each pivot high on the TLT corresponds. You'll notice that each time the TLT makes a top, the SPX is either near or at a sharp up-side move.

It's unclear if this pattern will repeat itself again, but there are several reasons to believe that it might. The market is extremely oversold right now as well as extremely bearish. History shows that when sentiment hits an extreme, it's often a sign that a turnaround is near. This combined with a possible pivot high in the TLT leads me to believe that stocks may be due for some short term upside in the near future.

If the market does bounce, I won't be expecting much--possibly a retest of the highs at 1350 or 1375. As you can see, the previous two pivot lows in the SPX were consecutively smaller declines leading to shallower bounces.

I'll be watching this correlation closely in the days and weeks ahead. If Treasuries rally sharply higher from here, or if it pulls back while stocks continue to decline, I'll know the pattern has been negated.